Paying taxes is always an unpleasant thing to do. Even you as an international student cannot escape it. All residents will be charged by the municipality for the so called user taxes.

Read how it works in general and what taxes you have to pay for as a (temporary) resident.

Landlord taxes and resident taxes for student apartments

Your landlord rents an apartment to you and has nothing to do with taxes the municipality is charging you as a resident. All Rotterdam residents pay taxes, while landlords as an owner pay their share of yearly taxes, which is even a higher amount. Moreover, in the rental agreement you signed, it is clearly stipulated in one of the clauses that the landlord pays his own tax-dues and you as tenants pay yours. Taxes are not pertaining to the building that is rented out but to state infrastructure and services you as inhabitant of Rotterdam. This is what the website of Rotterdam says about taxes.

What taxes have to be paid for?

Taxes (“Gemeentelijke heffingen” or “Belasting”) tenants may receive relate to:

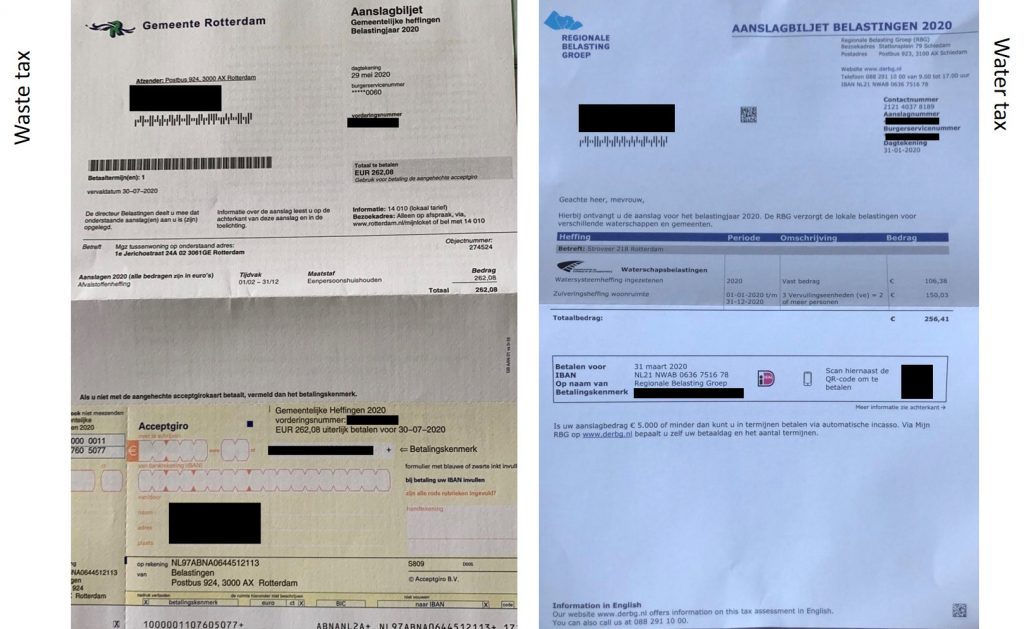

- ‘Afvalstoffenheffing‘ = waste tax. The garbage you are throwing away has to be collected and destroyed. The Gemeente Rotterdam takes care of this.

- Water management: for waste water management, dyke maintenance, etc. This tax is collected by Regionale Belasting Group (RBG) for the Regional water authority. The RBG uses words like “Waterschaps-belasting, “Ingezetenen-omslag” and “Zuiverings-heffing” horrible Dutch words, but that’s it!

Invoices… to whom and when?

One of your housemates will be invoiced as soon as you registered with the municipality, in February for water management tax and in May for waste tax. So there is no mistake who has been addressed on this bill. As addressee for any kind of taxes, you most expectedly were picked at random but this relates to all of you living in the apartment. You may therefore demand from your flatmates to share this equally with you.

If you have paid taxes for the whole year and you will deregister for example in July to go back to your home country, the remaining months will be refunded. Please make sure the company or the municipality that sent you the invoice knows to what bankaccount number the money has to be paid. If you closed your Dutch bank account, have them put your new bank account in their system even if it’s a foreign bank account.

Important to know

- Behind the word ‘vervaldatum’ a date is mentioned. Before that date your payment has to be in the mentioned bank account. Not paying your invoice (before the so called ‘vervaldatum’ or ‘ uiterste betaaldatum’) in time means you will be reminded (“aanmaning” or “herinnering”) and a penalty will be added on top of the taxes.

- Always mention the reference number on the invoice in your bank transfer, being called: ‘vorderingsnummer’ or ‘betalingskenmerk’.

How do invoices look like?

What if your income is not sufficient?

On the back of the invoice or in a separate letter information is given to object against the tax. Unfortunately all is in Dutch.

You could request for a (partial or total) waiver of this amount, declaring that you are a poor student and unable to pay that amount. Effectively, this means that if your total personal income is less than their standard per month, you are eligible for a waiver of this tax. This all relates to a formal income, such as: trainee fees, grants or wages. It doesn’t relate to cash donations you get by your parents.

How to apply for a waiver?

Visit the website of Rotterdam and search for ‘kwijtschelding’ or visit this web page. By using the automatic translation tool in the upper corner of the web page the text will appear in English.

However, since you would need a so called DigiD log in code for this digital procedure. It may be a better idea to go and visit the municipality Tax Office.

Please note that in any case, you first have to pay your taxes. If a waiver has been granted, the tax authority will compensate the excess amount paid.